How much do North End restaurants contribute to the City's operating budget?

How much do North End restaurants contribute to the City's operating budget?

North End restaurants contribute about $4,875,000 to the City of Boston's operating budget which is 0.0012% of the total budget.

Note: An astute reader points out that the 6.25% State Meals Tax actually comes back to the City. This could make the 6% slice in the current pie chart closer to 11% - which would make the North End's contribution closer to $10m or 0.0025% of the total budget.

--

I attended Cllr Coletta's budget town hall on Wednesday night. It was a great presentation and we're lucky to have a Councilor that advocates for us.

One question that came up during her presentation was where the tax revenue from North End restaurants was represented in the City's operating budget and whether some of that revenue could be earmarked for the North End.

I think the actual questions was, "Where is all the tax money that the restaurants bring in represented in that pie chart?" The implication was that the restaurants must be bringing in a sizable amount of money that makes up a good chunk of the operating budget.

Ignoring that fact that property taxes in Beacon Hill, for example, aren't (and shouldn't be) earmarked for Beacon Hill, I decided to look at the operating budget to try to deduce how much tax revenue the North End restaurants bring in and what percentage of the operating budget that represents.

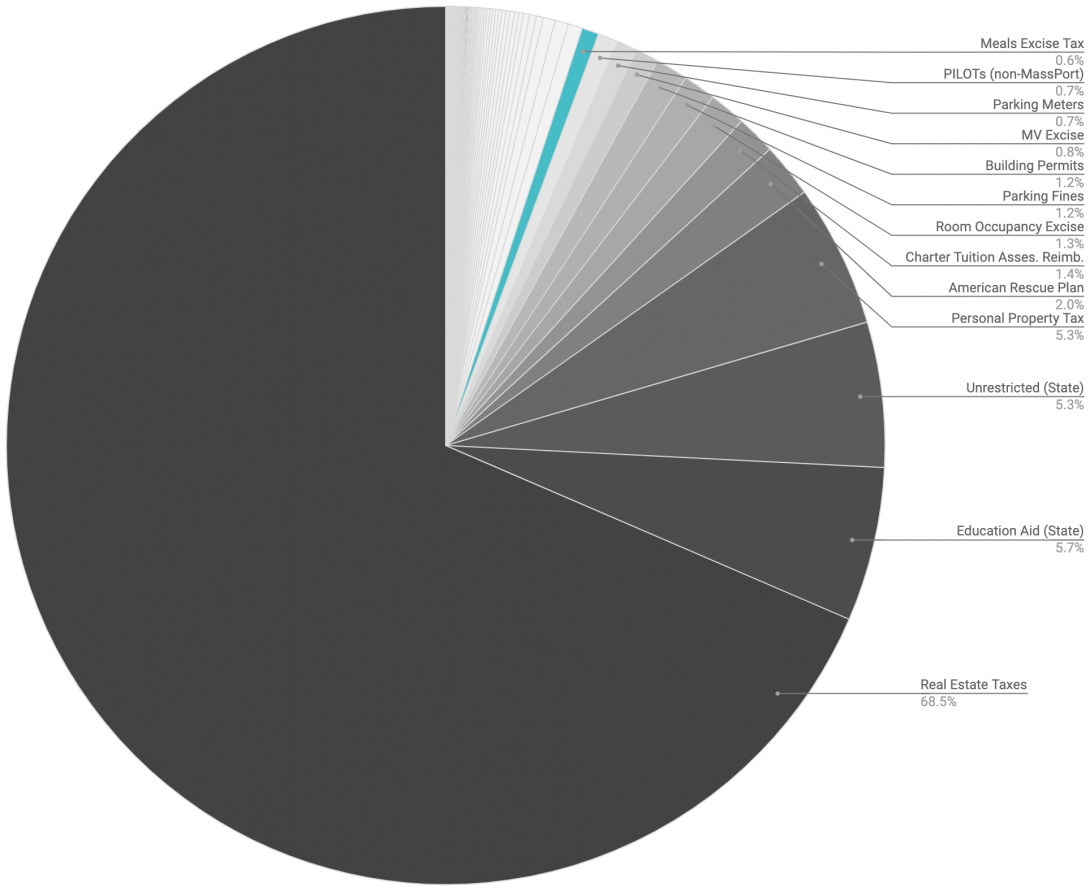

The total tax revenue from the City of Boston meals tax is projected to be 0.6% of the ~$4 billion fiscal year 2023 budget or $25 million dollars.

There are 187 North End and Downtown restaurants with liquor licenses, 13% of the total. If we (generously) assume these restaurants pull in 50% more tax revenue than the City-wide average, they would generate $4,875,000 in tax revenue in FY2023. $4.875m is about one tenth of one percent (0.0012%) of the City's $4 Billion operating budget.

Methodology

Of the 1,437 liquor licenses in Boston, 187 of them are located within the 02113, 02109, or 02110 zip codes. Note that this area includes a large number of restaurants that aren't in the North End, but the City doesn't break down liquor licenses by zip code. That's 13% of all liquor licenses. If we assume that restaurants in the North End (and surrounding areas) bring in, say, 50% more tax revenue than the average restaurant in Boston, those restaurants would account for roughly 19.5% of all meals tax revenue. Which is $4.875 million total revenue or 0.0012% of the City's operating budget.

Notes:

- The City says that property taxes make up 75% of the operating budget. But FY2023 says total budget is $3,993,813,929 and property tax revenue is $2,743,564,944 which is 68.70%. Not sure what I'm missing.

- As noted, the number of restaurants included is probably 80% larger than those strictly in the North End as the zip codes used to filter include most of Downtown. So the North End's contribution to revenue via meals tax is probably much lower than the 0.0012% calculated here.

- This doesn't account for restaurants that don't have liquor licenses. I assume they make up an insignificant percentage of meals tax and that they are distributed somewhat evenly across the city so as to not significantly alter the results.

- I used FY2023 Adopted budget. The last actual numbers are from FY2021. In FY2021, the North End restaurants contributed 0.00076% of the total budget - but that fiscal year included most of the lock down.

Add new comment